What Are the Car Title Loan Requirements in Ogden?

In order to qualify for car title loans in Ogden, you’ll need to meet a few preliminary requirements. A car title loan is a type of secured loan that can be flexible and convenient. If you qualify for title loans in Utah, you’ll be able to borrow against the value of your car by using your car title as collateral.

When you begin the application process for a car title loan in Ogden, you will need to meet the following initial requirements:1

- Be 18 Years of Age or Older: Applicants must be 18 years of age or older to apply for online title loans in Ogden.

- Have a Car with Positive Equity: While other factors are taken into consideration during your loan application, your eligibility for a car title loan in Utah is mainly based on your vehicle’s value and your ability to repay the loan. However, if you’re like many applicants, you may not know the current amount of equity in your car. Fortunately, you could use ChoiceCash’s online calculator tool to get an estimate and a loan quote, free of obligation!1 Contact a ChoiceCash title loan agent at 855-422-7402 if you have any questions about online title loans in Utah.

- Provide Proof of Income / Alternative Income: During the application process for Utah title loans, you must prove that you have the ability to repay the loan. You can submit a variety of documents during the application process, including bank statements, pay stubs, and benefit verification letters.

- Have a Vehicle Title in Your Name: A car title loan in Ogden, is secured by the title of your car or truck. Since collateral is used to secure the loan, the application process can be flexible. You could get title loans in Ogden, with bad credit!1 However, in order to use your vehicle as collateral for emergency funding, the vehicle title must be in your name. Qualified borrowers will also need to meet the title requirements in Utah. Typically, Utah borrowers will need to complete and sign a Utah Division of Motor Vehicles form TC-656, also known as a “Vehicle Application For Utah Title”. A title loan agent will usually assist a borrower with this form during the application process.

You can apply for a ChoiceCash title loan serviced by LoanMart from the comfort of your home in Utah! If you qualify, you could access competitive interest rates and obtain quick funding in as little as one business day.1 Visit the website or call 855-422-7402 to learn more about car title loans in Ogden.

What Do You Need for Title Loans in Ogden?

In addition to meeting the initial criteria for a title loan, you must submit some documents during your loan inquiry. ChoiceCash title loan representatives use these documents to verify certain information during your application, such as your address, income, and identity. If you gather the paperwork in advance, you could potentially speed up the approval process!1 Once you have the required documents on hand, you could conveniently upload them online without leaving your house.

Take a look at the list of documents that you will need to provide during the title loan application process in Utah:1

- Proof of Address

- Valid Government / State-Issued Photo ID Card

- A Utah Car Title in Your Name

- Proof of Alternative Income

- Recent, Clear Images of Your Car

When you apply for car title loans in Ogden, you may have to complete and sign a Utah Division of Motor Vehicles form TC-656, also known as a “Vehicle Application For Utah Title.” A title loan agent can assist you with this form during your application.

You can text or email all of your paperwork to a ChoiceCash title loan agent during the approval process! If you qualify for ChoiceCash title loans in Ogden, you could access competitive interest rates and zero hidden fees.1 Visit the FAQ section to learn more about this step in the application process.

Can I Get Utah Title Loans Without a Job?

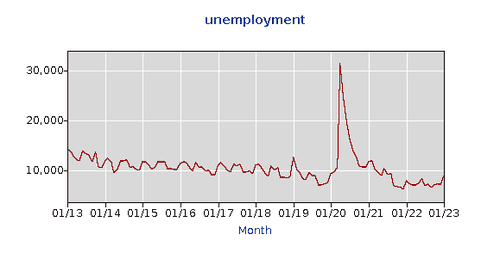

Yes, you could apply for Utah title loans without a job! However, you cannot qualify for a title loan in Utah without providing proof that you have the ability to repay the loan. While the unemployment rate in the city of Ogden is low, it is possible to get a title loan even if you do not have a traditional job or are currently unemployed.

But, you will still need to provide an alternative source of income to qualify for a car title loan. You can submit bank statements, benefit verification letters, or pension income during your application. Other forms of alternative income, such as retirement or settlement income, may also be accepted during the application process.1 Contact a title loan representative at 855-422-7402 or visit the FAQ page to learn more about car title loans in Ogden.

What Is the Highest Title Loan You Can Get in Ogden?

The highest title loan you can get in Ogden, will predominantly depend on the market value of your vehicle and your ability to repay the loan. Typically, you can borrow up to 50% of the total value of your car or truck if you qualify for a title loan in Ogden. You can find out if you qualify for same day pre-approval with ChoiceCash title loans serviced by LoanMart online today!1

Do I Need to Show My Car to Get Title Loans in Ogden?

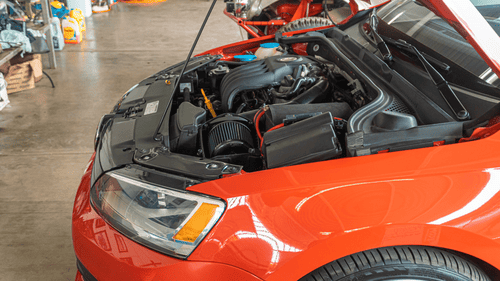

Your car or truck is an integral part of the application process for a title loan because it is used as collateral to secure the loan. You can expect to undergo a vehicle inspection during the approval process. Some title lenders may require an applicant to complete this inspection in person.

However, with a ChoiceCash title loan serviced by LoanMart, you have the option to complete the vehicle inspection online. Just submit clear photos of your vehicle to skip the hassle of a physical car inspection!1

Below is a list of the images you will need to provide to complete an online car inspection during your application for Utah title loans:

- The Front, Rear, and Sides of the Vehicle

- The Odometer Reading

- The Vehicle Identification Number (VIN)

You can conveniently upload the required pictures of your car on the ChoiceCash website during the approval process. A ChoiceCash title loan agent uses these photographs to verify the current condition and value of the vehicle. Don’t hesitate to dial 855-422-7402 if you have any questions about car inspections or title loans in Utah!1

Where Can I Apply for Title Loans in Ogden, With Bad Credit?

You don’t need a perfect credit history to apply for title loans in Utah! With ChoiceCash title loans, the application process for Ogden residents can be fast and flexible.1 You can use your smartphone or computer to apply for title loans in Ogden with bad credit.

Check out the convenient application process you could complete in just three simple steps:1

- Submit a Brief Pre-approval Form Online or Call a Title Loan Agent at 855-422-7402

- Upload the Required Documents or Email/Text Them to a Title Loan Representative

- Collect Your Funds if You Qualify for a Car Title Loan!1

If you qualify for funding, you could choose from a few different ways to get your emergency cash, such as:

- Have the Funds Added to a Debit Card

- A Direct Deposit to Your Bank Account

- A Check in the Mail

- Pick Up Your Money at a Participating Money Transfer Location in Utah

Find out if you’re eligible for auto title loans in Ogden, today! If you qualify, you could receive quick funding in as little as 24 hours!1

How Can I Pay for My Car Title Loan in Person?

Pay for your car title loan at any MoneyGram location in Utah. MoneyGram is often located in convenient public stores such as Wal-Mart, Kroger, or CVS. Call 855-422-7402 to discuss your options with a loan expert, or see the map and location list below to see where your nearest MoneyGram is located:

The addresses shown below display the nearest participating MoneyGram locations in the general vicinity:

Frequently Asked Questions

Does Utah Allow Title Loans?

Yes, you can apply for car title loans in Utah. That means you could use your vehicle title to secure the funds you need for an unexpected expense, even if you have bad credit!1

Where Can I Get Title Loans Near Me in Ogden, Utah?

You can get title loans near you in Ogden, without leaving your home! Just apply for a ChoiceCash title loan serviced by LoanMart online or over the phone today.

Do Auto Title Loans in Ogden, Utah, Affect Your Credit Score?

If you default on your title loan in Utah, that could negatively affect your credit score. Make sure to contact your title lender or loan servicer to discuss your options if you experience financial hardship during the repayment process.

What Happens When You Use Your Car as Collateral for Car Title Loans in Ogden, Utah?

Once the title loan is funded, your title lender will place a lien on your vehicle’s title. It will stay on your car’s title until you completely pay off your title loan. However, you can continue to drive your car throughout the repayment period if you pay your title loan on time.

What is the Lowest You Can Get on a Title Loan in Ogden, Utah?

Qualified applicants can typically access 25% to 50% of their car’s value through title loans in Ogden.1 You may not need to take the entire amount you are eligible for if you qualify for a car title loan, however.

Locations serviced near Ogden, Utah

ChoiceCash is proud to service residents all over Utah including metro areas . Call 855-422-7402 to discuss your options with a loan expert, or see the city list below to see where your MoneyGram locations near Ogden: